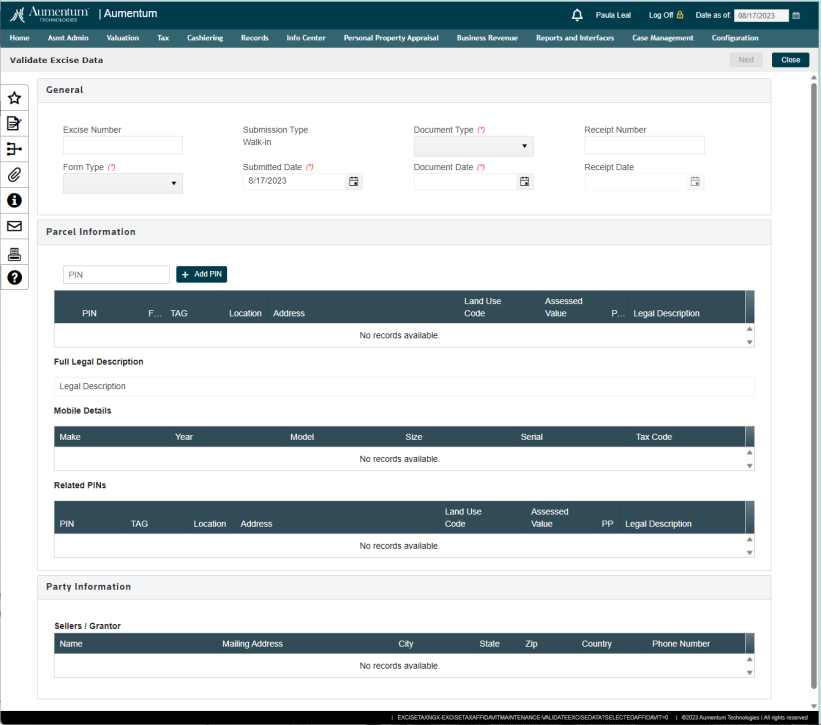

Validate Excise Data

Navigate:  Tax >

Excise Tax > Excise Tax Affidavit Maintenance > New Affidavit

Tax >

Excise Tax > Excise Tax Affidavit Maintenance > New Affidavit

OR

For efile submissions access this page by clicking on Workflow item link.

Description

Use this page validate information from the affidavit document against the data Aumentum has stored for the PIN(s).

Steps

-

When starting a new walk-in Affidavit, access the Affidavit Search page and click the "New Affidavit" button at the top of the page.

-

The Validate Excise Information page will display.

-

Select the appropriate Form Type for the affidavit and the appropriate Document type accompanying the affidavit.

-

Then enter the Document Date which will be the Sale Date for the transfer

-

Next enter a PIN and click the

button. Repeat this step for all PINs associated with the Affidavit.

button. Repeat this step for all PINs associated with the Affidavit.-

If a PIN has been entered incorrectly, then it is possible to remove it from the list by clicking the checkbox tot he left of the row and then selecting the

button.

button.

-

-

Click the checkbox next to each PIN row in the list to view and verify the information from Aumentum and compare this information to what is listed on the Affidavit form and the accompanying document(s). If all information is correct, then click the Next button, to move to the Affidavit Information page and complete entry.

**Note: This screen was designed to display the most relevant information from the PIN in Aumentum as it relates to the Affidavit. If other elements need review, then it is possible to access the InfoCenter page for the PIN by clicking the blue underlined PIN in the grid. This is a link to the PIN in InfoCenter.

Workflow

Affidavit Submissions from e-filers will use an interface to automatically enter the system. a work flow will be configured to look for these submissions and send them through some decision points for routing purposes before generating the work flow item for the Treasurer.

Workflow decision points:

-

Does the Affidavit have any options selected that require review for continuance? If yes, then notification will be sent to the Assessor queue for review and continuance determination and sign-off.

-

Does the Affidavit have any personal property related, or is there a use code that indicates personal property may be involved? If so, then route to the Revenue Officer queue for verification that all personal property taxes have been paid.

Regardless of which queue is notified, the next step will be to click on the Attachments link to view the documents associated with the affidavit and then to click the work flow link to access the Validate Excise Information page. The only difference will be that the PIN(s) will already be loaded on the page, therefore only the Step 6 from above will be required, unless related PINs are found that need to be added. If this occurs then enter the PIN(s) as described in Step 5 above.

Assessor Process

When e-filed notifications are received by the assessor they will access the attachments from the work flow event and follow their internal business process to determine whether a continuance should be granted or not.

When they are ready to update the affidavit, then they will click the link from the work flow queue to enter the Validate Excise Data page.

They will review the information on the affidavit and ensure it matches the information on the validate page and then click next to access the Affidavit Information page and complete their processing.

Revenue Officer Process

When e-filed notifications are received by the revenue officer they will access the attachments from the work flow event and follow their internal business process to verify all personal property accounts related to the PIN(s) in the affidavit have had their taxes paid.

When they are ready to update the affidavit, then they will click the link from the work flow queue to enter the Validate Excise Data page.

They will review the information on the affidavit and ensure it matches the information on the validate page and then click next to access the Affidavit Information page and complete their processing.